Back in April, Patrick Butler predicted that cuts to in-work benefits would “surprise and frighten Tory voters.” If Thursday’s Question Time is anything to go by, he was right. An angry Conservative voter tore into energy minister Amber Rudd over the government’s planned cuts to tax credits. Her outrage prompted this tweet from a Tory Party member:

I actually feel sick to my stomach to be a member of the Conservative Party tonight over #taxcredits. That lady spoke for millions #bbcqt

— Charlie Evans (@Chevans93) October 15, 2015

These are not isolated comments. There is a growing disquiet among Conservatives about the impact of tax credit cuts and the effect they will have on some Tory voters. Conservative supporting journalists have attacked the proposal and the Sun is running a campaign against it.

A poll for Sky News in the summer found that most people didn’t think tax credits counted as welfare. There was much higher support for cutting welfare than for cutting tax credits. Among Tory voters, 77 percent thought welfare should be cut but 50 percent were opposed to cutting tax credits. It is likely, therefore, that some people voted for welfare cuts without realising that they, too, counted as welfare claimants.

In the minds of many people, welfare still means something that only the unemployed get. If ever the stereotype of the work-shy dole scrounger were true, though, it certainly isn’t now. The unemployed are a shrinking proportion of benefit recipients. As this table from the OBR’s most recent Economic and fiscal outlook shows, the big lumps of social security spending are, in rough order, pensions, tax credits, housing benefit, disability benefits and child benefit.

The problem is, David Cameron has ruled out cuts to pensions and child benefit which doesn’t leave much to go at if you want to cut welfare by £12 billion. There is simply no way to do it without taking away in-work benefits.

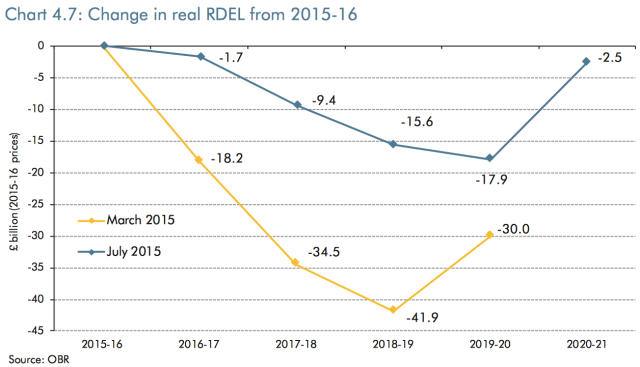

This gives Tory opponents of tax credit cuts a problem. Their stance is as arithmetically challenged as that of Labour MPs who refuse to oppose the fiscal charter. Eliminating the government deficit by 2019-20, without raising any extra taxes, will need a cut of around £30 billion from public spending. The government is planning a 60:40 split between cuts to public services and welfare, so just under £18 billion off public services and £12 billion off welfare.

If the government can’t cut welfare by £12 billion, it has to increase its public service cuts or abandon its deficit reduction target. Every pound the government fails to take off welfare costs has to be saved from public services, thereby increasing the likelihood of one or more of them collapsing before the end of the decade. Given that tax credits are the largest element of social security apart from the protected pensions, it is almost impossible to eliminate the deficit by 2019-20 without cutting them. Therefore, if you support the government’s deficit reduction target and you don’t want extra tax increases, you must support cuts to tax credits.

Voters have an excuse for not grasping the maths of this. They have other things to worry about. MPs haven’t though. They get regular briefings from the House of Commons Library explaining all this stuff. This is from the January update.

You see those gold bits? Those are tax credits. You can’t touch the dark green bits so tell me where else that £12 billion is going to come from.

It will be interesting to see how the government squares this one. Will it capitulate over tax credits and abandon its deficit target or put up taxes? Or will it hold the line and ride out the storm. Or will it, as I suspect, fudge a bit here and there, while hoping to God that something turns up.

Those receiving the tax credits would have spent the money, generating tax and more tax as respent.

So the whole analysis is wrong.

Even with 0.5% tax rates and a huge amount of spending, if there is no saving in the spending chain the govt gets *all* its money back as tax.

Which is why raising taxes and cutting spending don’t necessarily reduce the deficit.

To reduce the deficit peopl

It’s a simple maths progression.

All government spending generates an amount of tax and saving (“borrowing” from govt point of view.)

Where does the government get the money to pay for spending? By spending the money.

There are sufficient buffers in place to ensure there is always money in the account and if push comes to shove, there are cross facilities in place with private banks.

Ultimately this is all BS. Govt checks don’t bounce. The cost of the spending is the real resources it uses.

Scrap this and monitor real resource usage and give that to MPs.

http://www.3spoken.co.uk/2014/04/taxation-government-investment-each.html?m=1

‘cheques’

Pingback: 5% — October 2015 | Tipping Point North South

The notion that “You can’t touch the dark green bits” is the root of the problem. The triple-lock alone is costing £6bn.

The other big area is Housing Benefit. Planning reform is needed to bring down accommodation costs.

they should cut the homeowners tax relief (remove the CGT relief for prime residency).

Is it over 100bn?

They could cut pension credit (the not-so-dark-green bits).

Since the “minimum amount needed” is around £151, and the SP is around £113, most pensioners (state) also qualify for pension credit. That will change in 2016 when the SP will be around £151 under the new pension arrangements. So the NSDGreen bits will be smaller, and the dark green bit will be a bit bigger! Alternatively, they could cut the winter heating bits…..as one Tory wag said…they’ll be dead by 2020 anyway.

Cut all benefits that go to those earning over £100,000 for a start eg nanny tax, care4 tax back, mortgage interest relief, help to buy going to people buying houses worth £500,000 (as is happening in our local area !) etc… child benefit should be removed from those with two incomes of £49,000 but restored to famillies with one earner on £60,000 who is also heavily taxed bringing them back to the type of earnings people on benefits etc are almost approaching.

But main things – get big companies, and those who dont pay tax or who use offshore accounts to pay tax. I believe a few in the cabinet’s families have made money this way so there should be lots of expertise there about how to stop this !

but also the tax credits do seem to be incentivising young people and young families to be taking low paid jobs which really are the type of jobs that a number of us mums ,who are now returning to work as families have grown up, would like to have. And as we are not eligible for unemployment benefit if a husband is earning over £16,000 and we are not even counted as looking for a job then we are just a sort of hidden statistic – but many of us are trying to find work and cant.

Pingback: Lording it | juxtaposed