I managed to be out of the country for most of the party conferences so much of what I would probably have said has already been covered elsewhere. But just for the record….

The Conservatives’ statements on public finances were all over the place. Not only did Dave and George forget to mention an extra £13bn of public spending cuts, they also said they were going to offer tax cuts as well. Whether or not this will happen before the deficit is eliminated is unclear. The Prime Minister seems to have changed his mind on that since last Christmas. The IFS calculated that these tax promises would cost an extra £7.2bn. This would leave a 2015 Conservative government with £45bn a year (at least) to find from extra spending cuts, tax increases or borrowing.

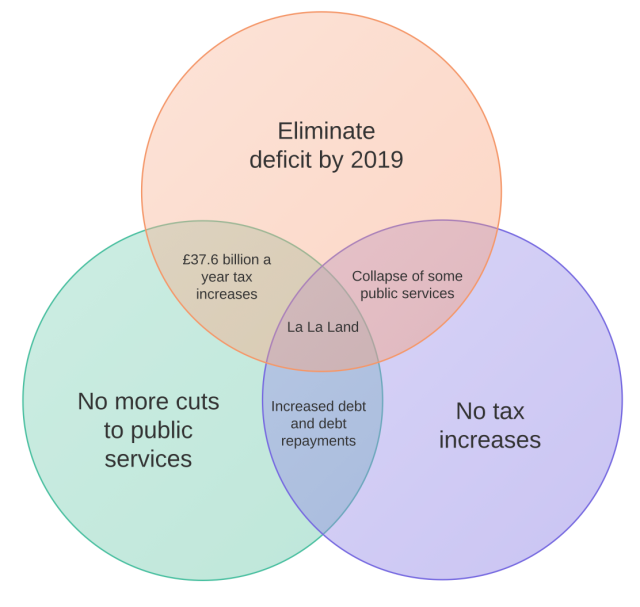

Jonathan Portes asked me if I was going to update my 2015 dilemma chart again but I’m not altogether sure how to show it on a diagram.

I suppose tax cuts could be a subset of the No Tax Increases circle and the bit overlapping in the middle would then be a subset of La La Land; something like Dipsy Land perhaps.

It is very unlikely that the next government, whoever is running it, will eliminate the deficit and run an absolute surplus by 2019. Not unless we get a quantum leap in economic growth, which delivers a bounty of unforeseen tax revenue, or the government increases tax rates by quite a lot. The scope for welfare cuts is very small so all the deficit reduction, plus any new spending commitments, has to come by cutting public services, as the Office for Budget Responsibility showed in it’s report last month.

As the Resolution Foundation commented (my emphasis):

[S]uch DEL cuts would produce reductions to some departments that to many will sound highly implausible. By 2018-19, budgets would need to be cut relative to 2010-11 by two-fifths in Defence and BIS, by half in the Home Office and by two-thirds in the FCO. Correcting for population growth would make the impact on public services appear starker still. It seems very unlikely that any of the parties will rely exclusively on DEL cuts to achieve their version of balance.

That’s about as close as you can get in polite, measured think-tank speak to saying Big Chinny Reckon.

You only have to look at the OBR’s projections to see how unlikely this is. Based on the government’s plans, the OBR expects public service spending to have fallen from 21.2 percent of GDP in 2013-14 to 16.3 percent of GDP by 2018-19. (There’s more discussion of the reasons why public services will bear the brunt of the spending cuts here and here.)

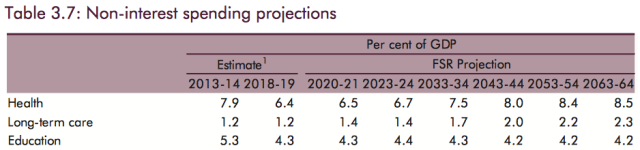

Now look at the OBR’s projections for health, long-term care and education for the same year.

That’s a total of 11.9 percent. Now add 0.7 percent pledged for foreign aid and 2 percent on defence to keep within NATO guidelines. That makes 14.6 percent, which leaves only 1.7 percent of GDP for everything else.

Now add in over £7 billion worth of tax-cuts.

It’s just not going to happen. Much of the rest of the state would have to be shut down.

There are one or two state-shrinking fanatics who think that the state could still run effectively with large parts of it hacked away but they are in a minority even in the Conservative Party.When public services start disappearing, Conservative voters are just as likely as anyone else to start kicking up a fuss and government ministers know it.

This is one area where the Conservatives are not being outflanked on the right either. Despite what some commentators have said, UKIP isn’t Britain’s Tea Party. Many of its voters are relatively left-wing on a lot of economic issues. In some respects, they are to the left of the Labour leadership. Much of what they want, including tougher immigration controls, implies higher public spending. If anything, UKIP supporters want more state, not less. These voters will not be won back by a slash and burn attack on public services.

There is very little appetite among voters for a major reduction in the size of the state. The British Social Attitudes Survey shows that public opinion on taxation and spending has shifted over-time from favouring more spending to keeping things the same. Keeping things the same is a long way from what the Conservatives are proposing though. Those in favour of the sort of reduction in public service spending implied by the government’s plans have never registered above 10 percent. There is no support for public service cuts on this scale.

Given recent developments, it might be that the cuts would have to be even deeper than the OBR estimates, as Frances said last week:

Given recent developments, it might be that the cuts would have to be even deeper than the OBR estimates, as Frances said last week:

[T]he fiscal consolidation of 2010-12 is widely believed to have delayed the UK’s recovery. The UK is now growing, but the recovery is by no means established: inflation is below target, wage growth is even lower and households are still highly indebted. The UK faces headwinds from slowing global growth, the chronic Eurozone crisis and the prospect of Gulf War Three. It is distinctly possible that another sharp fiscal consolidation would squash this recovery too. Repeating what has been done before may not be wise.

She concludes:

The fact is that the Conservatives’ fiscal plans have a hole the size of a small planet. Mind you, Labour’s aren’t much better: Miliband’s promises were clearly driven by worries about losing Scottish Labour voters to the SNP, while Balls was equally clearly driven by worries about losing votes to the Conservatives. Two scared parties, abandoning common sense and good economic management for the sake of winning an election. Fiscal rectitude has been sacrificed on the altar of realpolitik.

She’s spot on, apart from the ‘real’ bit. There’s nothing real about this at all. It’s Dipsy Land Politik – even further into fairyland than before.

What we need is a Bankers’ Tax – that’ll cover it.

Reblogged this on sdbast.

£37.8bn per year tax needed? Why not reclaim avoided and evaded tax properly? That will more than fill the gaps and will work if any government has the spine to do it.

Meanwhile , we are told that the other ‘Dave’ didn’t mention it at all . I guess it’s a bit of an embarrassment ….

Pingback: Public finances: From La La Land to Dipsy Land – Flip Chart Fairy Tales | Vox Political

I don’t think I’ve seen a more clueless or lucky Chancellor in my adult life then George Osborne.

A particularly notable aspect of his performance is his statements about what the market will and will not do. He regularly commandeers “the markets” to give support for his policies and damn Labours, but his record on market commentary is awful.He started in 2008; the pound had crashed from around 1.9$ per £ to around 1.37, at which point he said if we weren’t careful there could be a run on the pound – keep up George – and there was promptly a bounce back to around 1.50.

More notable is his commentary on the deficit. He got elected in 2010 promising he would eliminate the deficit by 2015 and that the slower piece of Labours policies would lead to Britian being punished in the bond market leading to economic turmoil. In fact he has hopelessly missed his deficit target, been far worse than Labour promised, and the reaction of the bond market to his profiligate record is to throw money at him at ever lower rates.

The paradox is that the growth of which he boasts is down solely to his massive miss on his own deficit target. if he had achieved his target we would be in the same defllationary spiral as most of Europe.

Nobody believes a word politicians say any more, especially those concerning the economy. The fact Osborne’s completely missed his target to eliminate the deficit in five years comes as a surprise, I suspect, only to you. This blog, depressing though it is, does point out the harsh realities extremely well, the Venn diagram at the very top being a prime example.

The markets know that a deficit that’s been 70 years in the making isn’t going away in the next 20, let alone five, but the direction of travel is what pleases them. Eliminating the deficit would, of course, be bad for the money lenders. They’ll do everything they can to make it easy to continue the current trend, knowing that politically it’ll be impossible to crack down heavily on spending when most of it is ring-fenced, thus continuing their cosy arrangement in perpetuity.

Deck chairs and the Titanic come to mind.

Implement temporary LVT for 5-10 years and then use the money to build more house and reduce the housing benefit.

But have no faith at all that this will happen.

What is happening with the pension obligations? Is it true that the “pension regulator” (not sure what is the correct name) is running out of money due to the low wage growth?

Pingback: Diagrama de Venn | jrcheca

How much impact would effective taxation of companies like Amazon have? Is it negligible in the context of the figures in the blog post?

Pingback: ET fees: We have to stop chasing unicorns in Fiscal La La Land | Hard Labour

Didn’t you deny saying that spending cuts sqashed the recovery?

Pingback: Will business flinch in its support of deficit reduction? | policy and