Rachel Reeves caused a bit of a stir at the weekend when she said that people earning £60,000 don’t feel rich and should not pay extra tax.

The focus should be on a privileged few right at the top, and that’s not people earning £50,000 or £60,000 a year. If you’re a single-earner family in the South East on [that income], you don’t feel particularly rich, and you’d be aggrieved that people earning between £150,000 and £1 million are getting a tax cut. We don’t have any plans or desire to increase tax on people in that band of income.

She didn’t actually say, ‘£60k isn’t rich’ but that was the headline that appeared soon afterwards.

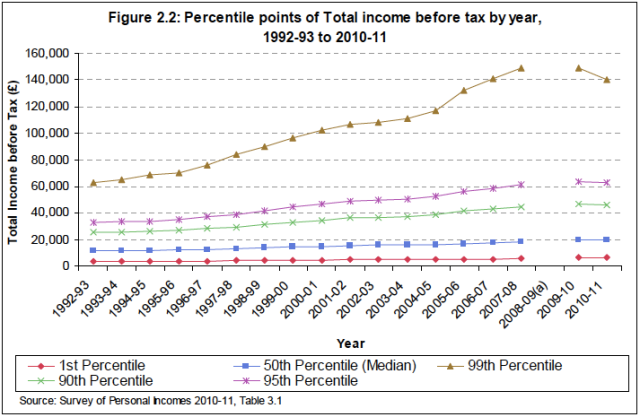

Is £60,000 rich? Well it depends what you mean by rich. According to HMRC figures, a before-tax income of £60,000 would put you in the top 5 percent of earners.

If you want to check out the exact percentile in which your income falls (and I’m sure you do), you can download the full table here.

If you earn £60,000 a year, then, you are earning more than 95 percent of the population and almost twice as much as the highest earners in the bottom three-quarters. To most people, £60,000 will make you look comfortably off, at the very least.

But Rachel Reeves doesn’t want to increase taxes on those earning £60,000. She hints, although she doesn’t actually say, that the top 1 percent should pay more.

Both the main parties are playing a little game with the voters. They would have us believe that ‘ordinary people’ won’t have to pay for the hole in the public finances that the next government will have to tackle. The left say that will tax ‘the rich’, the right say that the gap will be closed by cutting payments to dole scroungers and sacking a few more useless public servants. The soothing message from both sides is that someone else will cover the costs. You, Mr and Mrs Ordinary Voter, will not see any tax increases or any degradation in the public services on which you have come to rely.

Whoever wins the next election will have to find another £25 billion a year, either from taxation or from cuts to public services and social security – cuts on top of the ones implemented during the current parliament. IFS Director Paul Johnson reckons that trying to plug this gap with spending cuts alone will lead to a complete collapse of some public services. According to calculations by Murray Rothbard, based on HMRC figures, the top 1 percent would need to be taxed at 65 percent to raise an extra £25 billion. It is unlikely that even a Labour government would go this far.

The most likely outcome is further spending cuts and tax increases during the next parliament, with the balance being more towards cuts under a Tory-led government and more towards tax under a Labour-led one. What is absolutely certain, though, is that ‘ordinary people’ will feel the pain. They will see cuts to public services or they will have to pay higher taxes. If Labour wants to avoid further cuts and implement some of its new ideas, it will have to increase taxes for all but the poorest. Even if they manage further spending cuts, the Conservatives will still have to raise taxes by at least the equivalent of 1p on income tax.

I’ve got some news for people on £60,000 a year. You might not feel rich but, before the decade is out, you will be paying more tax. Don’t let politicians from either side kid you otherwise.

Pingback: Does £60,000 a year make you rich? - Rick - Member Blogs - HR Blogs - HR Space from Personnel Today and Xpert HR

Hi Rick, cracking post as ever. Just to clarify, what would a household income of £60k look like on a graph of household incomes? Put it another way – £60k is 95th percentile of individual incomes, what is the equivalent 95th percentile of household incomes? I agree entirely that “£60k is not rich” doesn’t wash, but as the overwhelming majority of people on £60k live/earn/spend as households, this might be illuminating…

cheers!

Interesting…I have some friends who are on a combined income of over £80.000 a year. They have a lovely family home that is paid for. They have a holiday home in Spain that is paid for. He drives a Nissan Qashqai, she drives an Audi TT. They have two beautiful daughters who have been through University and both have good jobs. My friends are in their mid-50’s – he is retired from a public sector job on a final salary pension of over £40,000 a year, and she is still working in the public sector on over £40,000 a year. They don’t think they are rich.

They need to get out more.

It is often assumed that the media stories about benefit queens with a “massive fucking TV” (thanks, Jamie Oliver) are primarily directed at the poor and intended to get them to turn on each other. We easily forget that the chief purpose (along with aspirational guff about the rich and famous) is actually to encourage the well-off to believe that they aren’t well-off enough and should therefore support regressive policies.

Johnathan Portes did a very interesting analysis on tax incidence by age. I forget the exact details (due to my age?) but it is difficult to escape his conclusions that the elderly and retired should be contributing more by way of tax.

As for raising the top rate of income tax to 65%, what’s wrong with that, particularly on unearned income? Surely, if the thrust of government policy is “to make work pay” then unearned income should be frowned upon and discouraged, just as social security benefits are frowned upon. Imposing a flat rate of 65% on unearned income may encourage incredibly gifted and deserving people (we are told) to contribute their skills and aptitudes to the commonwealth. This would be good for society and good for the characters of the individuals affected

“We [met] partners in a law firm of international renown and senior staff from equally world-famous merchant banks… the law partners earned between £500,000 and £1.5m per year, putting them in the top 0.1% of earners in the UK, while the merchant bankers ranged from £150,000 up to £10m… When asked to relate themselves to the rest of the population, these high-earners utterly misjudged the magnitude of their privilege.

“How much, we asked our group, would it take to put someone in the top 10% of earners? They put the figure at £162,000. In fact, in 2007 it was around £39,825, the point at which the top tax band began. Our group found it hard to believe that nine-tenths of the UK’s 32m taxpayers earned less than that. As for the poverty threshold, our lawyers and bankers fixed it at £22,000. But that sum was just under median earnings, which meant they regarded ordinary wages as poverty pay.”

You can read the rest of the extract, from Unjust Rewards by Polly Toynbee and David Walker, at http://www.theguardian.com/money/2008/aug/04/workandcareers.executivesalaries.

Cheers

Dan

The Wikipedia page http://en.wikipedia.org/wiki/Income_in_the_United_Kingdom has more up to date figures with the 95th percentile for 2012/13 at £68,500; factor in the South East angle and £60K is obv further down the scale (for the SE) though clearly everyone needs to get out more rather than comparing themselves to the Joneses.

Nick – Well, yes, but those figures are only projections. The 90th percentile is still well below £60K so perhaps £60k puts you in the top 7% rather than the top 5%.

As for regional differences, taxes don’t recognise variations in cost of living. People on £60k in London probably don’t feel rich at all but they’ll be right in the firing line for any tax increases.

There is of course another way of looking at all this. If you are a young(ish) professional earning 60k per year then there is a good chance you need to work in a London or a prosperous town in the south east. You probably want to live in a areas with good rail and road links and (if you have a family) you probably want to have a good schools nearby. Factor in the costs of getting housing in such areas and your disposable income suddenly drops quite significantly and therefore you probably don’t feel rich. [Of course the situation is completely different if you were able to buy your housing before the 90s/00s bubble and don’t have children – as per akismet-3280fe66a77b37530ef4a8e7a0faa33c’s example]

No doubt many left wing readers will have little or sympathy for this predicament (and possibly with good reason), however, I suspect that Labour need to be VERY careful about their message on benefits and social housing etc if they to avoid completely alienating young professionals….

@Paul

But their message is to say they won’t increase income tax on those earning £60k, presumably (partially at least) because of the reasons you outline. It is Rick who is saying that Labour will raise tax for this income group

These ONS figures give some useful data on household income

http://www.ons.gov.uk/ons/publications/re-reference-tables.html?edition=tcm%3A77-280824

According to some, the definition of rich is that you never think about how much a car (or anything reasonable) costs when you buy it. If you do, and you can still buy it cash, you are wealthy.

Now there are rich and wealthy people out there who earn money from their investments and there are those who have the same income but actually have to work.

I earn over 60k and I don’t feel rich. I don’t own the home I live in. My equity is south of 100k. I think the question of whether you are rich has more to do with your equity levels than your income levels.

I agree that wealth is what makes you feel rich, not income, after all wealth can be defined as the state of being rich!

Incomes declared to HMRC by definition exclude incomes from a) the black economy (affecting the whole income spectrum) and b) offshore investments (skewing the top). Some charts that factored estimates of those in would be interesting.

Very nice article. I like it. Being rich or being healthy, which would you prefer? Money is not the most important thing in life. I think your health is the utmost factor that you need to pay attention too. Some rich people don’t know about this important thing. They try to get richer until one day, tons of money, weak health, what’s the point to have money? Even though money is important but your health is more important.

£60k as household income (rather than personal income) puts a household somewhere around the 85-87th percentile, not the 95th. People like this should emphatically not be clobbered with more tax, and should pay less. Households on incomes of some £40k to £100k are the people who keep this country going, and who go out and get the training, put in the extra hours, come up with the bulk of the ideas that keep businesses, universities and the public services functioning as well as they do (despite daily battles with over-regulation and petty-fogging restrictions), invest their pension pots and savings in the future of the economy and generate invisible exports (by getting dividends back from abroad), and need and deserve nurturing and rewarding for their virtue. The real fiscal reform this country needs is to shift from individual income tax to household income tax, not difficult to administer in the digital age. Whack the top rate up to 48% (the optimum level for getting revenue in), and have it kick in at the point where households earn over £150k, with the 40% band only kicking in when households earn over £100k. Virtue rewarded, striving encouraged, less need for tax credits for the middle class (except in those families who see a parent take time out as parental leave), but inequality between the top 2% and the rest diminished.

I have only just seen this article. I earn around 63k as a Deputy Head of a secondary school in the North West. Had the government not increased our pension contributions from 6% to 11.3% in the last 5 years and had not done away with SERPS, further decreasing my take home pay, I may have felt better off. I work around 60 hours a week and would not say I feel rich.