My late father-in-law used to joke about the pensioners jugging up in the pubs and clubs of South Wales. He reckoned the old folk drank more than the youngsters. It certainly seemed that way last time I was in his local Wetherspoons just before noon on a Tuesday lunchtime and found the place full of sixty- and seventy-somethings tucking into pub lunches.

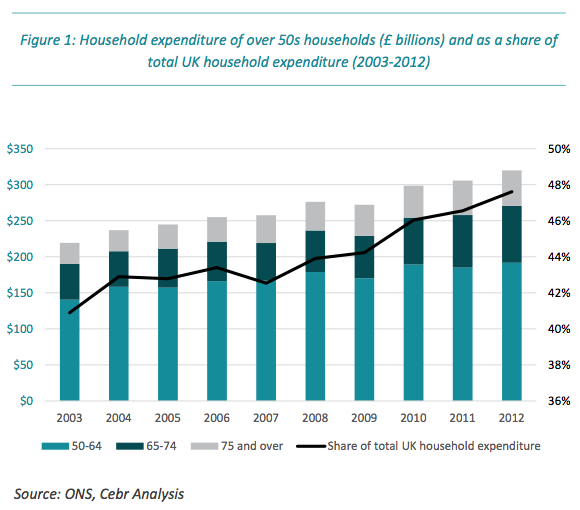

A CEBR report for Saga, published last month, found that the over 50s account for a greater share of household spending than they did a decade ago.

And, as my father-in-law would have predicted, their share of spending on eating out and boozing has risen the most.

The over 50s are only one third of the population but they do more than their fair share of drinking, travelling and eating out.

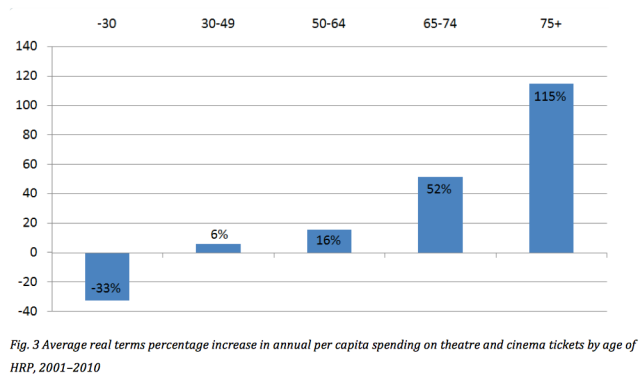

Research in 2012 by the Intergenerational Foundation found similar patterns. Leisure spending by pensioners has risen considerably over the last ten to fifteen years.

Research in 2012 by the Intergenerational Foundation found similar patterns. Leisure spending by pensioners has risen considerably over the last ten to fifteen years.

Change in spending on theatre and cinema tickets 2001-2010

Change in spending on foreign travel 1999-2011

Change in spending on eating out 2000-2010

Of course, some of this increase is due to the fact that there are more older people now than there were a decade ago. Numbers alone can’t account for all of it through. The over-50s went from 33.3 to 34.7 percent of the population between 2001 and 2011. The proportion of the over-65s increased from 15.9 to 16.4 percent. (See the 2011 Census.) Much of the rise in spending among older age groups is due to accumulated wealth and generous pensions.

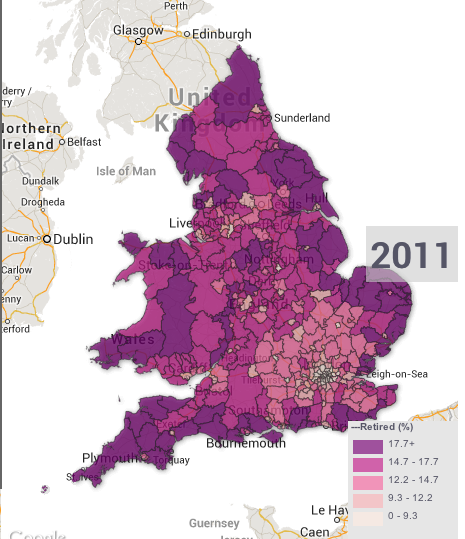

I touched on this when The Economist called time on Britain’s old industrial towns last year. I have no firm data for this but I reckon pensioner spending is one of the reasons why some of these towns have avoided economic collapse. Many of the old industrial areas have a high proportion of retired people. Their money is keeping these places afloat.

Percentage of retired people by local authority

Source: ONS Census Data

In a sense, the industries that once sustained these towns are still present, in the form of their pension funds. As my father-in-law explained, in his part of South Wales. many of his contemporaries had pensions from the government, the old public bodies, such as the National Coal Board and British Rail, or the big industrials, like Ford, BOC and British Steel. The young people pulling pints, running around with plates of food and packing shopping bags were kept in work by the generous spending of the active retirees.

Pension funds based on the individual and corporate prosperity of the boom years have been sustaining former workers long after the industries that created that wealth disappeared.

But what will happen when these pensioners die or become too infirm to spend and are replaced by the next wave of retirees?

Many of the aforementioned companies have closed their final salary pension schemes; British Steel in 2009, BOC in 2011 and Ford in 2012. Despite closing its final salary pension over a decade ago, BT is facing a rising pensions deficit. Even the solid John Lewis is having to cut back on entitlements as its pension deficit rises.

According to the Department for Work and Pensions, the number of people in defined benefit schemes has more than halved over the past two decades. Over the next decade, fewer people will retire with the generous pensions that previous generations enjoyed.

DWP projections suggest that the amount paid out be defined benefit pension schemes will start to fall sometime around now and will decline steadily over the next few decades.

It is extremely unlikely that the defined contribution schemes will pay out anywhere near as much as the old defined benefit schemes. A recent study by Bath University found that the shift to defined contribution schemes will leave many people with insufficient funds for retirement. In January, a Policy Exchange paper warned of a pensions time bomb as the number of over 65s rises while the funding for their retirement falls. There will be a lot more old people but a lot less pension money to go round.

Falling pensioner spending is going to be a problem for the whole economy, especially one so reliant on consumer spending, but it will hit some areas particularly hard. Most of us now accept that we will have to work beyond what we now consider to be normal retirement age. But that assumes that there are jobs available. If pensioner spending is preventing economic collapse in the old industrial towns, what happens when that spending stops? Instead of ordering food and booze in Wetherspoons, the over 65s will be competing with the young people for the bar jobs.

Generous pensions are the afterglow of our old industries. Once they are gone, some places may struggle to keep the lights on.

The problem here, is that todays pensioners are reaping the benefits of extracting their due deserves from a lifetime of earning and paying into the system. This, in consideration of todays ‘benefit’ culture, shows how people of working age who are paid benefits (whether in work or not) skew the system from one where people paid into the pot, therefore expecting to take some of that back, to a system where people no longer pay into the pot but still have the same expectations of their entitlement from the ‘pots’ resources …. RESULT … the pot will empty very quickly but the sense of entitlement will remain the same! Very dangerous territory!

Pingback: The Stuff of Thoughts… | Back Towards the Locus

Excellent post and a topic that is not getting enough open discussion and exposure. It is accurately described as a time bomb with wide fall out predicted.

So much for the idea collectivism is bad. All those claims that private thrift can produce adequate pensions were always a lie. Its as if the ruling class only care about profits!

Reasons to be cheerful; part one:

http://www.moneywise.co.uk/pensions/your-retirement/benefits-pensioners-10-reasons-its-good-to-be-retired

30% discount at local theatre.

A zero-prescription rate, instead of 28 quid per month (note that many GPs´ are now cutting drugs precribed because local CGs´ have to pay the cost now, not the DoH).

Parger pubs offer pensioner doscounts….

And you wonder why they spend more locally……

50% rail redustion for local travel, a-la-travel concession…

Pensioners paid into work and state pension all their lives and far more than the 44 years in many cases, or the 30 years now. The National Insurance Fund is full, not needing a top from tax for decades. As the NI Fund is not a tax it cannot be emptied as ring fenced so cannot be used for general expenditure by government.

The flat rate pension coming in 2016 will even deprive the poorest pensioners turning 80 that year.

https://you.38degrees.org.uk/petitions/state-pension-at-60-now

The 1950s Baby Boomers that are the children of the pre-war generation now pensioners, will end up with not only less money, but NO STATE PENSION FOR LIFE.

Poorest workers and women (women born from 1953 and men born from 1951) –

housewives, divorcees and widows

no food money for life.

https://you.38degrees.org.uk/petitions/state-pension-at-60-now

Women lost state pension payout at 60 from 2013 for 6 years,

are suffering a 50 per cent unemployment rate in UK outside of London,

over half of over 50s are within working poor either employed or

low insecure income self-employed.

The next generation of pensioners are already retired before 60 from over 1 million austerity job cuts (now and due by 2018), with average woman’s council works pension only £2,800 and men’s only £4000 per year (2013 figures).

Ageism in job recruitment once over 50 and even more over 60.

The working poor / low income self employed are the bulk of those on housing benefit (going to well to do landlords not the poor) and going to food banks.

The days of eating out, entertainment and travel will have gone by 2016 when flat rate pension reduces state pension massively for new claimants.

The high street’s have died in many towns where too many pensioners only have the state pension as income, the lowest in the richest nations already.

«A recent study by Bath University found that the shift to defined contribution schemes will leave many people with insufficient funds for retirement.»

That’s a common and very big misunderstanding: insufficient funds for retirement are not really the effect of a switch to defined contribution, that was largely done to hide the other and much bigger change: employers have cut pension contributions from around 25-30% of salary to around 5-10%.

If emoployers were to contribute 25-30% of salary to defined contribution schemes new style pensions would be more volatile but worth much the same as old style pensions, but because they and employees contributing usually one third of that in total, new style pensions will be around 1/3 of old style pensions, but not because of the switch in the type of pension.

This switch has been done brilliantly to mask the enormous cut of 20% in the effective compensation of employees. Trade unions surely understand this, but they have kept well silent as they reckon that workers don’t get it, and to avoid pointing out that under current legislation they are largely ineffectual.